AVCF

Avareum Cash Flow Fund

Avareum Cash Flow Fund’s goal seeks to provide cash flow

generated to the investors for the bear market.

Why Investing in Avareum Cash Flow Fund?

Portfolio Diversification to Crypto Options

Diversified portfolio that primarily invests in crypto options chosen for their fundamental properties. The fund may make any size investment in crypto options. Under typical circumstances, the fund will invest at least 70% of its assets’ value in Bitcoin options.

Investing in Reliable Crypto Assets

We choose to hold options positions in Bitcoin and Ethereum without leverage in order to continuously receive the option premium as a cash flow for our portfolio.

Crypto Yield > Traditional Finance Yield

Replacing unnecessary burden costs of conventional fund management with Smart Contract to boost up the bottom-line performance returned to investors.

Transparency

As it functions on blockchain technology, all transactions and records are auditable.

Fund Objective

The Avareum Cash Flow Fund is a diversified portfolio that primarily invests in crypto options chosen for their fundamental properties. The fund may make any size investment in crypto options. Under typical circumstances, the fund will invest at least 70% of its assets’ value in Bitcoin options.

During a cryptocurrency sideways or bear market, our investment adviser searches for cash flow by investing in crypto options. We examine crypto fundamentals in order to identify attractive underlying crypto for our options strategies.

Documents

Date as of June 15, 2024

Performance

Fund Details

| Fund Name | Avareum Cash Flow Fund |

| Subscription | Monthly, End Of Month |

| Redemption | Monthly, End Of Month |

| Management Fee | 2.00% |

| Performance Fee | 10.00% |

| Front-End Fee | 3% |

| Transaction Fee | 0.5% per tx |

| Expected Return | 15-30% |

| Expected Drawdown | 10% |

| Return Generating | Cash Flow and Capital Gain |

| Fund Platform | Cayman Islands Open-Ended Fund |

| Risk Level | Medium-High |

| Leverage | ≤ 2x |

| Minimum Subscription | 30,000 USDC |

| Investment Platform | Deribit |

Investment Strategy

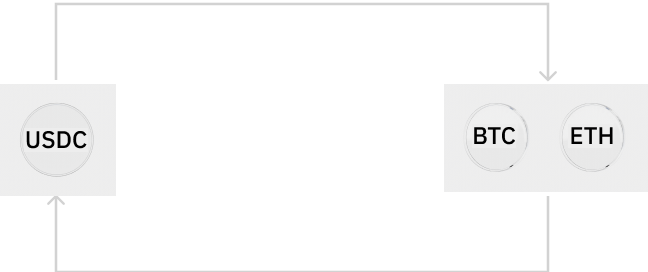

2. Crypto Position Phase

(Undervalued)

When the underlying crypto is undervalued or trading at a significant discount, we will hold those cryptos in our portfolio and sell call options to profit from our investments.

1. Cash Position Phase

(Overvalued)

When the crypto market is uncertain and the underlying crypto is not undervalued, we will sell put options to profit from our investments.

Management Team

Niran Pravithana

Fund Manager

Theerawat Songyot

Chief AI Scientist

Napat Vitthayanuwat

Risk Manager

START INVESTING