AVFF

Avareum Fundamental Fund

Enable investors to capitalize on the expanding digital asset landscape by balancing high growth opportunities with strong fundamentals through active, risk based management.

Why Investing in Avareum Fundamental Fund?

Digital Assets as a Megatrend Opportunity

Blockchain-driven digital assets transform finance, providing unique investment opportunities with enhanced efficiency and transparency, while our Strategy leverages global crypto adoption and expanding use cases.

Active Portfolio Management

Active portfolio management enables capturing the upside potential of developing digital assets through deep analysis and understanding of various token systems. Our dedicated team provides strategic insights to help maintain investors’ current holdings.

Diversification for Stability and Growth

Diversification manages risk and return. Our balanced approach emphasizes achieving diverse exposure to large-cap cryptocurrencies and emerging opportunities by integrating on-chain data with traditional expertise.

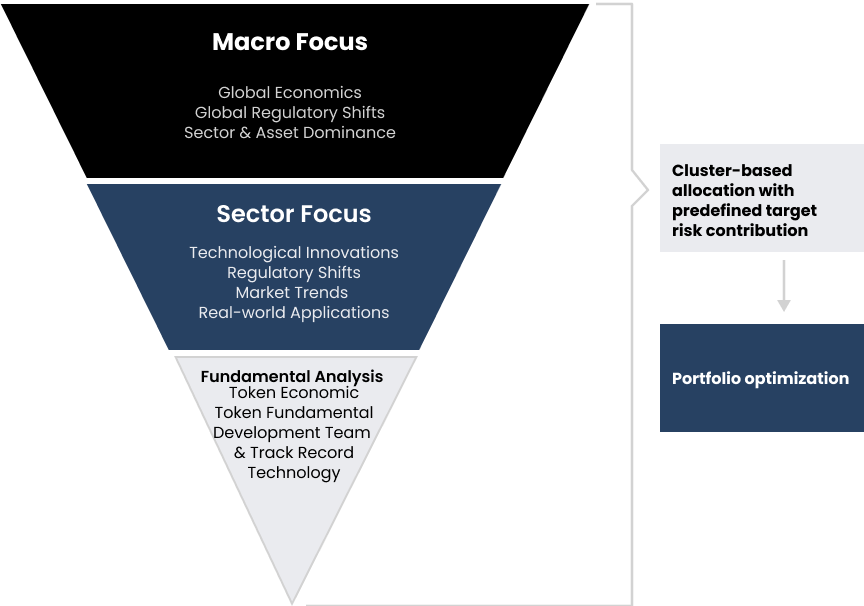

Risk-based Portfolio Optimization

Utilize a cluster-based approach to capital allocation and distribute target risk between two asset groups based on informed assessments.

Fund Objective

The Fund is designed to capitalize on the high-growth opportunities presented by digital assets, marking a new era in investment possibilities. The fund seeks capital appreciation by strategically balancing investments in Foundational Leaders and High Conviction Assets. Employing a risk-focused approach, it combines active management and rigorous risk mitigation strategies to optimize returns and maintain a resilient portfolio suitable for sophisticated investors.

Documents

Date as of June 15, 2024

Performance

Fund Details

| Fund Name | Avareum Fundamental Fund |

| Subscription | Monthly, End Of Month |

| Redemption | Monthly, End Of Month |

| Redemption | Monthly Redemption |

| Management Fee | 2.00% |

| Performance Fee | 20.00% |

| Front-End Fee | 3% |

| Investing Platform | Binance |

| Expected Return | 50% |

| Expected Drawdown | 30% |

| Return Generating | Capital Gain |

| Fund Platform | Cayman Islands Open-Ended Fund |

| Sharpe Ratio* | 1.85 |

| Risk Level | High |

| Minimum Subscription | 30,000 USDC |

| Leverage | 1x |

*The Sharpe Ratio is calculated by dividing the excess return of an investment by the investment’s standard deviation. While this methodology provides a useful measure of risk-adjusted return, it is important to note that it relies on various assumptions and statistical models. We may update constantly based on the future changes in factors.

Investment Strategy

Investment Themes*

(*) Investment themes are categorized using The DACS framework for digital asset classification.

Managements Team

Niran Pravithana

Fund Manager

Theerawat Songyot

Chief AI Scientist

Napat Vitthayanuwat

Risk Manager

START INVESTING